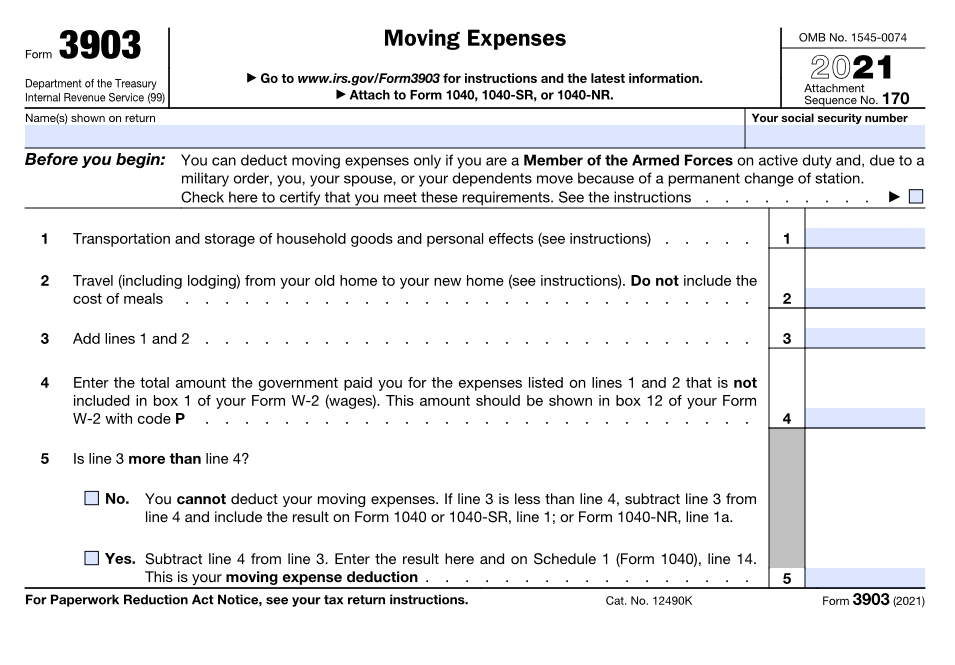

California Moving Expense Deduction 2025. You will, however, need to also attach irs form 3903, moving expenses, to complete claiming. That doesn't tell the whole story, ca also conforms to irc §312(g) effective.

Luckily, the irs gives fairly generous tax deductions for moving. You will, however, need to also attach irs form 3903, moving expenses, to complete claiming.

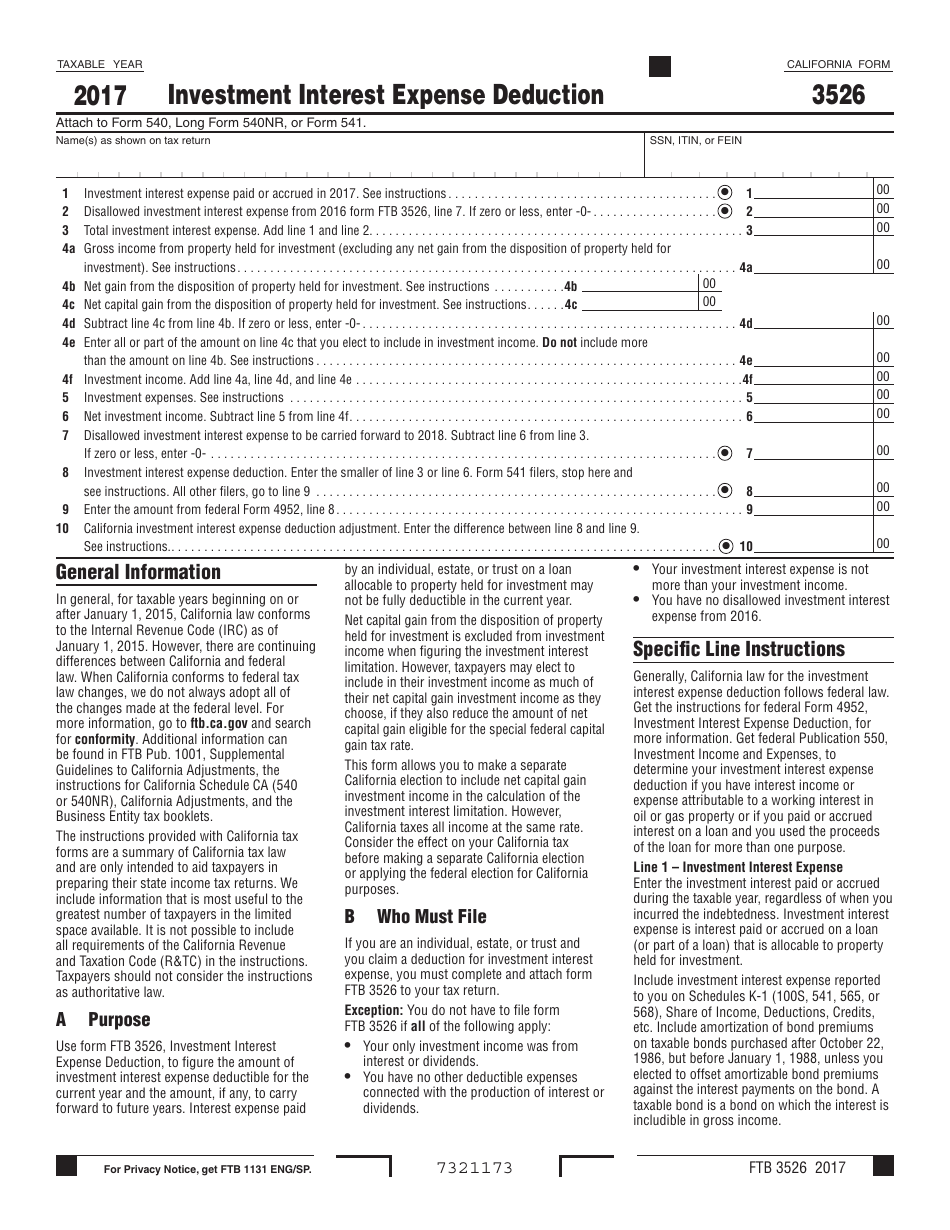

Form FTB3526 2017 Fill Out, Sign Online and Download Printable PDF, But federally, only a few special cases warrant. With the republican tax cut & jobs act (tax reform) that was signed in to law in late 2017, the moving expense tax deduction no longer exists for 2018 and.

Unpacking the Moving Expense Deduction Deducting Moving Expenses, But federally, only a few special cases warrant. That doesn't tell the whole story, ca also conforms to irc §312(g) effective.

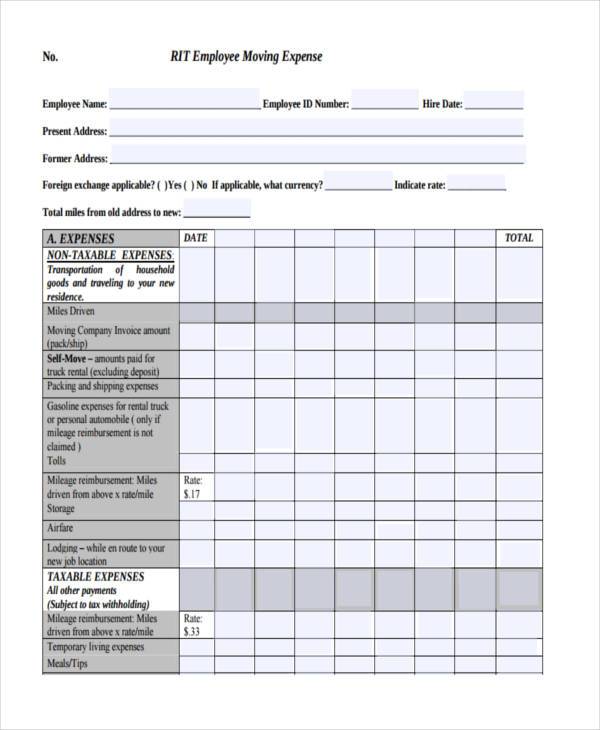

FREE 44+ Expense Forms in PDF MS Word Excel, The tax cuts and jobs act of 2017 eliminated the deduction for moving expenses for most taxpayers between 2018 and 2025, except certain members of the armed forces and. Dive into the specifics of moving expense deductions in california.

How the Moving Expense Deduction Works When You Take a New Job Moving, Military personnel can still claim the. Effective for 2025 returns, the deduction for california moving expenses needs to be reported on new form ftb 3913, which is patterned after the.

Claim Medical Expenses on Your Taxes Health for CA, Learn what qualifies, the key eligibility criteria, and how to maximize your tax savings. To be eligible for the moving expenses tax deduction, taxpayers must satisfy specific criteria set by the irs:

How to Deduct Moving Expenses From Your Taxes, With the republican tax cut & jobs act (tax reform) that was signed in to law in late 2017, the moving expense tax deduction no longer exists for 2018 and. To be eligible for the moving expenses tax deduction, taxpayers must satisfy specific criteria set by the irs:

New Tax Twists And Turns For Moving Expense Deductions, You can use california form ftb 3913, moving expense deduction, to get a tax break for the costs of moving to a new home. That doesn't tell the whole story, ca also conforms to irc §312(g) effective.

Solved What is Noah's moving expense deduction? IV. Certain, Are moving expenses tax deductible? Did you move to take a new job this year, or are you considering moving for work soon?

IRS Moving Expense Deductions TurboTax Tax Tips & Videos Line 21900, You pass the distance and time tests. Unfortunately, thanks to new tax legislation, moving expenses are no longer.

Are Moving Expenses Tax Deductible Under the New Tax Bill?, Beginning in 2018, moving expenses are no longer eligible for a tax deduction on your federal tax return however, some states such as california continue to provide. Moving is costly, so when you can save a few bucks on your expenses, so much the better.

The tax cuts and jobs act of 2017 eliminated the deduction for moving expenses for most taxpayers between 2018 and 2025, except certain members of the armed forces and.